Swedish Coworking Market Report Q3 2025 – Stockholm, Gothenburg & Malmö

After a few turbulent years, Swedish coworking has quietly moved into a new phase. The traditional office market is still wrestling with high vacancies, but flexible space has, in many places, done the opposite: filled up.

In our latest Q3 2025 market report, based on detailed room-level data from 270 coworking locations and more than 10,500 private offices across Sweden, we see a market that has largely completed its post-pandemic clean-up – and is now running surprisingly hot in the best micro-locations.

Below are the key trends shaping Swedish coworking right now.

If you wish to receive the full report please reach out to us for a full copy.

A Consolidating Market: Less New Space, More Full Offices

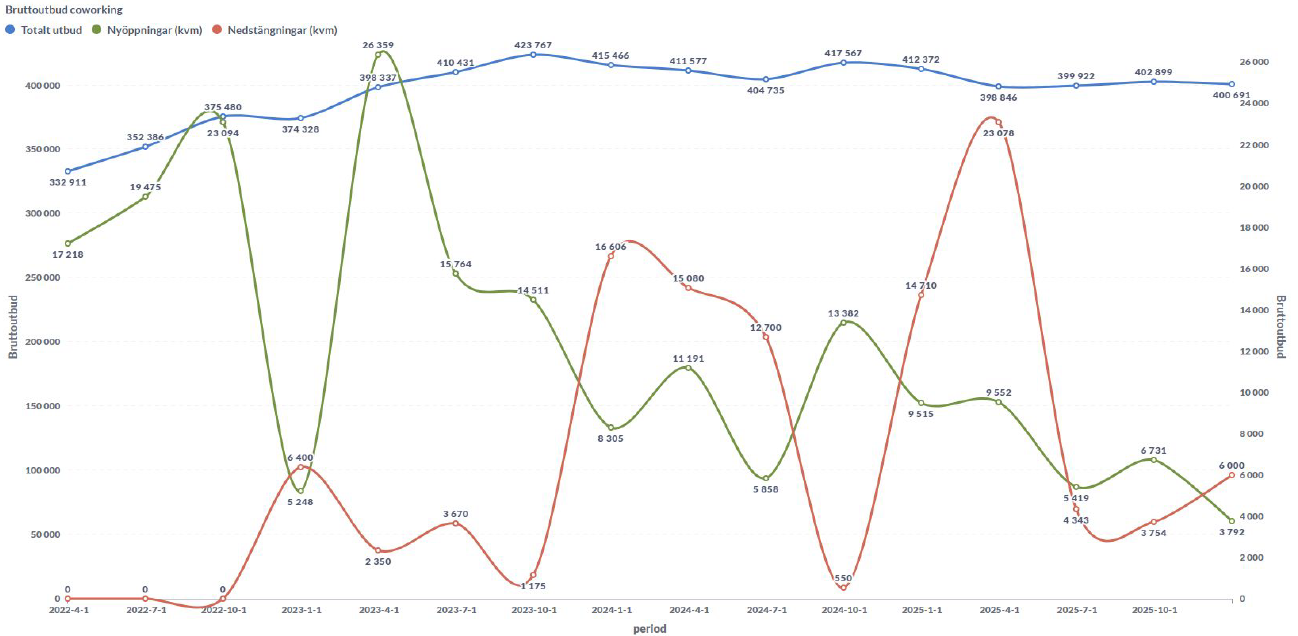

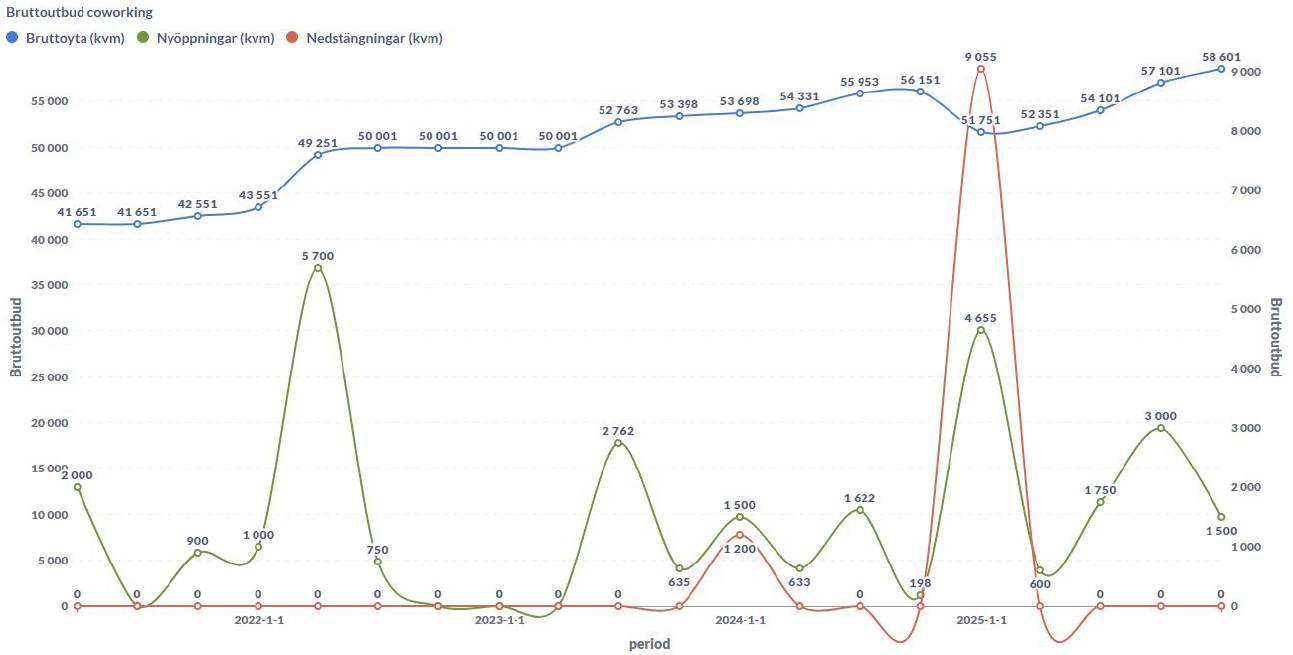

If you zoom out, Swedish coworking is no longer in aggressive expansion mode – it’s in consolidation mode.

Across Stockholm, Gothenburg and Malmö, the total amount of coworking space has more or less plateaued. New openings are happening, but they’re largely being offset by closures, operator exits, takeovers and rebrandings rather than big net additions of fresh square metres. Much of the “new” supply is really space changing hands between operators rather than true expansion of the flex sector.

At the same time, occupancy is rising in many of the key coworking markets, even as the traditional office sector continues to wrestle with high vacancy and weaker demand. In central Stockholm in particular, the combination of limited new supply and several closures over the last 12–18 months has pushed coworking occupancy sharply higher and made certain micro-locations feel almost sold out.

In other words, we’re seeing a tightening flex market inside a slack overall office market:

- The general office market is still struggling with structural vacancy and slow reletting.

- Coworking, on the other hand, is quietly absorbing demand – especially for small and mid-sized private offices in strong locations – without adding much new space.

For operators and landlords, this consolidation phase is crucial. It means the focus is shifting from “how fast can we grow our footprint?” to “how efficiently can we run, fill and position the space we already have?” For tenants, it translates into less choice and firmer pricing in prime coworking locations, even though headlines about the broader office market might suggest the opposite.

Stockholm: “basically full” Inside The City

No city illustrates this better than Stockholm.

1. A dramatic recovery within the inner city

The headline statistic:

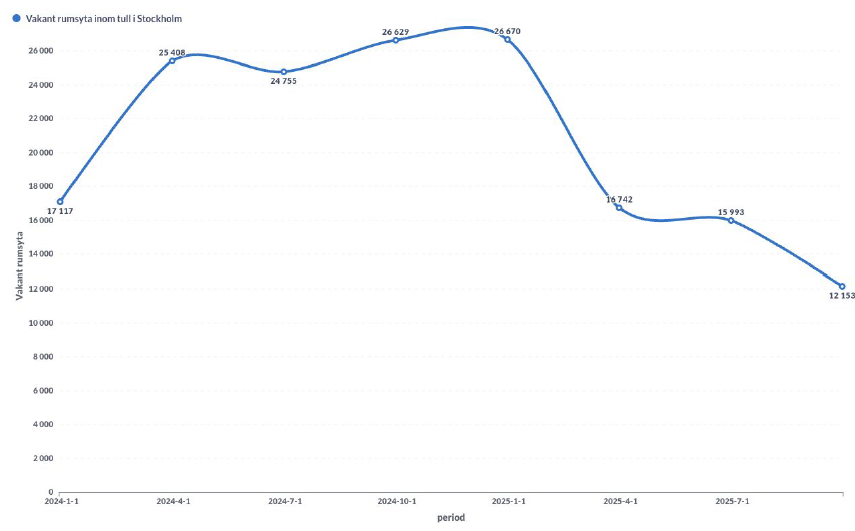

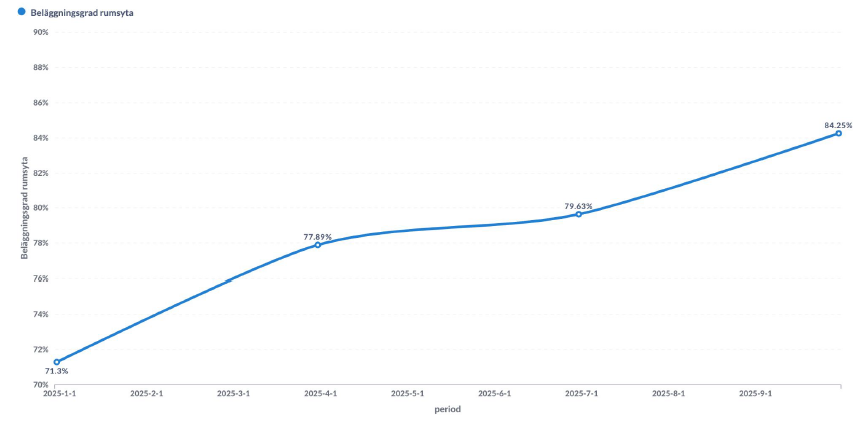

Within the tolls, there are now just over 12,000 m² of vacant room area in coworking – down from almost 26,700 m² a year ago. Over the same period, average occupancy jumped from 71% in Q4 2024 to 84% in Q3 2025.

For a market that went through waves of closures and downsizing, this is a complete turnaround. In practical terms, it means:

- Many popular locations and room sizes are sold out.

- New enquiries often end up in waiting lists or in less central districts.

- Operators have much more pricing power than they did 12–18 months ago.

2. Greater Stockholm: high occupancy, limited new supply

Zooming out to Greater Stockholm (Stor-Stockholm), the report shows:

- 403,000 m² gross coworking supply (up slightly from 400,000 m² last quarter)

- 237 locations

- 78% occupancy (up from 75%)

- Average rent: 1,298 SEK/m²/month

What’s striking is how little net new space is coming online. The previous year is dominated by closures, takeovers and rebrandings rather than big expansions – A house Filmhuset closing while A house Sickla opens, Quick Office exiting Mall of Scandinavia, The Works leaving Strandbergsgatan, and so on.

At the same time, coworking already accounts for around 7% of total office stock in Stockholm’s CBD, and 4–5% in other key submarkets – a high figure by Nordic standards.

3. The mix that works: 3–10 person rooms

The size breakdown for Stockholm tells a clear story:

- 3–5 person rooms: 27% of lettable room area, 75% occupancy

- 6–10 person rooms: 32% of area, 76% occupancy

- 11+ person rooms: 25% of area, 78% occupancy

- 1–2 person rooms: 16% of area, slightly lower 70% occupancy

For operators and landlords, the message is straightforward:

The core demand is still for small and mid-sized private offices.

Gothenburg: growth pause and a more tenant-friendly market

Gothenburg tells a different story – one of stabilising supply but stubbornly low occupancy, markedly lower than pre 2025 levels.

Across the metropolitan area, the report shows:

- 103,000 m² of gross coworking supply (flat quarter-on-quarter)

- 67 locations

- 67% occupancy (slightly down from 68%)

- Average rent: 926 SEK/m²/month

After several years of expansion, the market has, for now, stopped growing. But unlike Stockholm, that pause hasn’t translated into tight occupancy; instead, Gothenburg is still operating well below “comfortable” levels across most districts.

City centre under pressure

Coworking supply in the city centre has grown almost 50% in just a few years, to 68,000 m².

Occupancy sits at 66%, with particularly high vacancy in 3–5 and 6–10 person rooms – usually the sweet spot of the sector.

This suggests a segment that may be temporarily saturated. Good news for companies hunting deals; tougher for operators trying to maintain rate levels.

Even though the market struggles with occupancy pricing trends show that rents have been steadily creeping up as operators try to reach profitability in their centers. A combination that sets a tough challenge.

Lindholmen: attractive, but not yet full

On Lindholmen, one of Gothenburg’s flagship innovation districts, the picture is similar. The district has a stable supply of around 11,300 m² of coworking, but occupancy is only around 65%, with an unusually large share of vacant larger offices as well as the smallest 1–2 person units.

For operators, the opportunity lies in reconfiguring space and re-segmenting product: chopping some of the larger suites into mid-size rooms, or repositioning offers directly towards scale-ups and project teams.

Malmö: steady expansion, slower absorption

In Malmö, the coworking story is one of continued growth in supply, currently outpacing demand growth as occupancy falls.

Key figures for Q3 2025:

- 57,000 m² of gross coworking stock (up from 54,000 m² last quarter)

- 44 locations

- 68% occupancy (flat)

- Average rent: 622 SEK/m²/month (up from 593, despite a broader downward trend over the last year)

Over the past quarters, Malmö has seen a string of new openings and announcements:

- Granitor Properties has opened 3,000 m² in Hyllie.

- Spaces Hyllie Vista is adding another 1,500 m².

- High Court Börshuset will open 3,600 m² of flexible space.

Even with that pipeline, absorption has been modest. Smaller room categories – 1–2 and 3–5 person rooms – hover in the low-to-mid 60% occupancy range, while larger 11+ person rooms reach almost 80% occupancy, suggesting that Malmö’s growth is, for now, slightly more anchored in larger tenants and project teams.

In comparison to Gothenburg, prices have fallen dramatically in Malmö over the last two years. Even though occupancy is down, total amount of leased out space is on the rise, showing that there is stable demand for the coworking product.

For operators, the city is a long-term growth bet: the macro story and development pipeline are strong, but pricing and product need to be tuned carefully to keep filling space.

Micro-markets: Stockholm’s CBD is almost sold out

The Stockholm market shows a clear picture of a divided market - one where city locations are highly regarded and other markets struggle.

Stockholm CBD West & East: flex at near-structural capacity

- CBD West combines flat supply (almost no new space for two years) with 89% occupancy and average rents of 1,860 SEK/m²/month. In simple terms: it’s basically full.

- CBD East has seen more closures and restructuring, but still reaches 79% occupancy, with very high headline rents – on average 2,113 SEK/m²/month, and a spread where the top quartile reaches well above 2,600 SEK/m²/month.

In both CBDs, coworking typically represents around 7% of the total office stock, making flex an integral – not marginal – component of the core city office ecosystem.

Vasastan vs Solna/Sundbyberg: two very different stories

- Vasastan sits at 82% occupancy with stable supply, but little net growth in leased area – a mature, relatively balanced submarket. Average rents land around 1,805 SEK/m²/month.

- Solna/Sundbyberg continues to grow in supply (37,000 m², 22 locations) but has a lower 66% occupancy and a five-fold spread between the cheapest and most expensive rents.

That spread signals a two-tier market: some highly amenitised hubs leveraging good transport and corporate neighbours, and a long tail of more price-sensitive sites fighting on rate rather than product.

What this means for landlords, operators and tenants

For landlords

Coworking’s 3–4% share of total office stock is already meaningful – and concentrated in the most valuable parts of each city.

In Stockholm’s CBD, flex is effectively running at structural capacity, hinting at the potential for new projects or conversions if the right operator partnerships can be set up.

In Gothenburg and Malmö, landlords should see coworking as a demand engine and risk-sharing tool, but must be realistic about current occupancy levels and build in enough runway.

For operators

Product mix matters more than ever.

The data is clear: 3–10 person rooms are still the engine of the business, while very large “big office” solutions need to be tailored to the demand.

Location drives pricing power.

Rents in Stockholm CBD East and West sit dramatically above suburban levels, and even within Solna/Sundbyberg the spread is extreme. Choosing the right building and micro-location is more important than amenities.

Secondary cities require sharper positioning.

In Gothenburg and Malmö, operators need to be crystal clear about who they’re building for – freelancers, scale-ups, corporate project teams – and design their mix of room sizes, memberships and services accordingly.

For tenants

If you’re an occupier, the market is now bifurcated:

In central Stockholm, especially within the tolls and in the CBDs, you should expect limited availability, waiting lists and firm pricing.

In Gothenburg, Malmö and suburban Stockholm, you’ll find more choice, more negotiation room and wider price bands, particularly for mid-size teams.

For many companies, that will mean splitting demand: securing a small, high-value footprint in a prime location, supported by cheaper flex space in secondary districts.

A data-driven view of Swedish coworking

All of the figures above come from yta.se’s own ecosystem: our marketplace, our daily brokerage activity and, crucially, occu, our inventory management system that tracks supply and pricing at room level. In total, the dataset behind this report covers:

Over 10,500 private offices

270 coworking locations across Sweden

More than 120 MSEK in annualised rents mediated to coworking in 2024

We only include locations where we have 100% room data from the operator, and we continuously cross-check against “old-fashioned research” on gross floor area, openings, closures and submarket boundaries.

That means the picture isn’t just anecdotal – it’s built from the actual spaces, prices and vacancies that make up today’s Swedish coworking market.

If you’d like to dive deeper into your specific submarket, benchmark your own locations or understand where the next opportunity is likely to emerge, the full premium version of the report goes down to district level and into price bands, room sizes and efficiency metrics.

Until then, the takeaway is simple:

Coworking in Sweden has moved out of recovery mode. In the right places, it’s already scarce – and that’s reshaping how tenants, operators and landlords think about the office.