Guide: Office rent indexation in Sweden

Updated 2025-12-03 to include the index for 2025 as well as information about the new base year for KPI

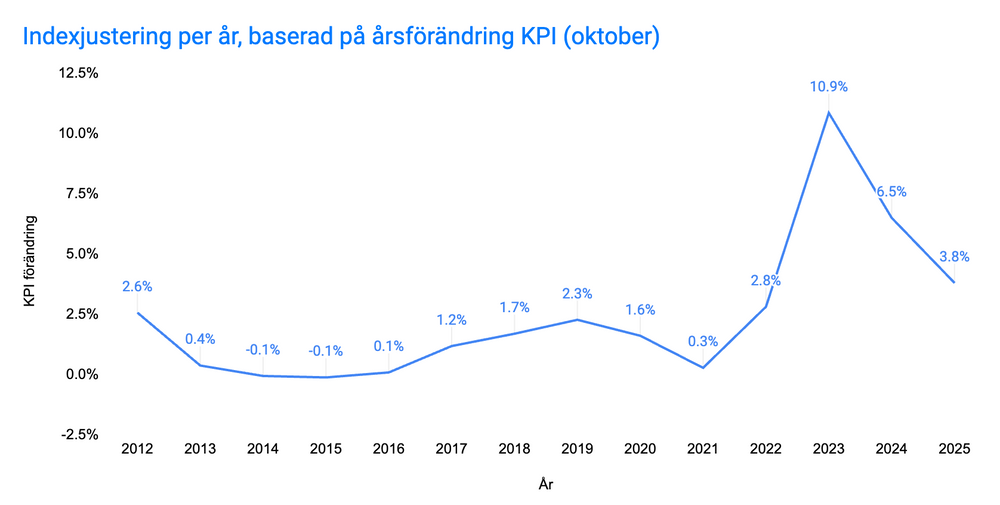

All of a sudden the rent invoice for the first quarter of next year lands in your mailbox and you notice that the rent is substantially higher. In previous years this increase has often gone unnoticed, but for 2023 the increase that the majority of Swedish companies are hit with is 10.9%, for 2024 the increase is 6.5% and for 2025 it is 3.8%. The increase is specified as an index adjustment – but what is that, actually?

The first reaction for many is to be surprised and maybe even a little angry. Is there anything I can do about this? Is this really specified in my contract?

Unfortunately, they will quickly realise that the lease they signed contains an index clause that gives the landlord the right to periodically adjust the rent based on various parameters. This clause applies throughout the entire contractual relationship and cannot be changed.

What is indexation?

The purpose of indexation is to let the rent follow inflation in society. Especially for office leases, which are often long, the mechanism is intended to allow longer tenancies without having to renegotiate the rent as the surrounding world changes.

The rent is tied to an index which, annually, quarterly or monthly (depending on the lease), is compared to the index in the previous period. The rent is adjusted by the percentage increase in the index over that time.

In practice, indexation is most often one-sided in the landlord’s favour, meaning that the rent is only allowed to be adjusted upwards and not downwards. It is also common to have mechanisms stating that the index must always be at least a certain percentage.

The Consumer Price Index, KPI, is the most common index to link the rent to. It is defined by Statistics Sweden (SCB) as follows:

How have rent indexations affected rents over the years?

When this post was first written in December 2022, Sweden and the world were going through one of the worst inflation surges in a very long time. The majority of lease agreements have index clauses that are adjusted annually according to KPI based on the October index, and the graph below is based on that approach.

If the index adjustment to be applied to the 2023 rent is to be calculated, KPI with base year 1980 for October 2022 is compared with KPI for October 2021. The change becomes the adjustment applied to 2023.

As the graph above shows, the last 10 years have fluctuated between -0.1% and +2.8%. Unfortunately it has been very common to have floors in index clauses, i.e. a minimum level that the index is allowed to be. Of the many lease agreements we at yta.se have seen over the years, 2% is the most common. This means that in practice the annual increase has been between 2% and 2.8%.

For 2023 the rent adjustment was 10.9%, which came as a shock to many tenants. For 2024 the adjustment is 6.5%, almost a halving, but still a historically high increase. For 2025 it is also high, with an increase of 3.8%.

New base year for KPI from 2026 – how it affects you as an office tenant

From January 2026 KPI (Consumer Price Index) will change base year to 2020, from the previous 1980. SCB will continue to publish KPI with base year 1980 until 2030 – after that only the new base year will be reported.

Because two base years will be reported during this transition period, it can be important to keep track of what applies when you sign or renegotiate office leases. Even though it is primarily an administrative adjustment and has little practical impact for you as a tenant, it is always important to know what applies.

If you sign or renegotiate your commercial lease during 2025, the 1980 base year applies because there is nothing else to refer to yet. However, the parties may agree to apply KPI with base year 2020 when it starts being published.

If you sign or renegotiate your commercial lease during 2026, the index clauses should be linked directly to KPI with base year 2020.

If you are in an existing lease that expires before 2030, the index clause should already be linked to the previous base year 1980 and no changes need to be made. If, however, the lease runs until 2030 or longer, you and your landlord will in due course need to agree on an adjustment. This can be done either in a renegotiation or through an addendum where the index clause is replaced.

What different types of indexation clauses are there?

First of all we need to clarify when an index clause may be used. In Sweden, variable adjustments of the rent over time may only be applied to lease agreements that are 3 years or longer. In shorter agreements indexation can still be applied, but then with a predetermined amount.

Fixed indexation

In the coworking industry, fixed indexation is what applies in most cases. This means that you agree in advance on an increase that usually takes place on an annual basis.

Before inflation started to rise, this was usually 2%. Right now many operators have chosen to increase it to varying degrees, but the highest we have encountered so far is a fixed increase of 6%. Despite that, they are most likely themselves facing high indexations in the background.

Since coworking is a full-service offering where everything is included in the rent, the indexation automatically applies to the entire rental cost.

Variable indexation

Variable indexation clauses are most often applied in the form of an appendix to the lease agreement drawn up by the organisation Fastighetsägarna. This is an industry standard that defines the conditions for indexation, including when the first indexation is to take place depending on what time of year the lease starts.

After that it is not uncommon to have special conditions that further regulate the indexation.

Over what time period is the indexation? This can be monthly, quarterly or annual. Today annual is most common, but quarterly has become increasingly common.

What governs the outcome of the indexation? It is very common with restrictions that do not allow the index to be negative (i.e. the rent is at lowest unchanged), or a floor such as at least 2% per year.

What part of the rent is index-regulated? Most often 100% of the base rent is indexed, and then there are additional regulations for supplements. Sometimes a specific index is applied, for example for electricity costs. The only thing that is not indexed is the property tax; instead it is reassessed every 3 years, and if it is revised upwards you also become liable to pay that increase.

What can you do about it?

The first thing you should do is have a dialogue with your landlord. If you are in a financially exposed situation there may be an interest in finding a joint solution. Keep in mind, however, that your landlord has full rights to charge this cost increase, and if you are not on a flexible lease such as coworking, it is often a long time before the threat of termination is even possible.

What you should not do is stop paying the rent. Even being late with the rent payment can directly affect the lease, and the landlord can then also withhold the security deposit you have provided.

Last but not least, you can look into the possibility of a more flexible agreement. Being locked into 3–5-year agreements when needs can change quickly, and so can the costs we have just gone through, can easily become a trap. At yta.se we mainly work with the “new” office market in the form of flexible offices in coworking spaces and serviced offices, or directly from property owners. These offices include full service, the possibility to sign with as little as 1 month’s commitment, and an ease of scaling up and down over the lease period. Today there are fantastic solutions even for larger teams of 20–100 people, which you can read more about here.

Interested in knowing more? Don’t hesitate to visit our marketplace with over 10,000 offices in Sweden.