Inside Sweden’s Coworking Boom: yta.se’s 2024 Market Report

Zoomed out - Key Performance Indicators

Swedish Coworking Supply - compiled by Yta.se, Swedens largest coworking broker

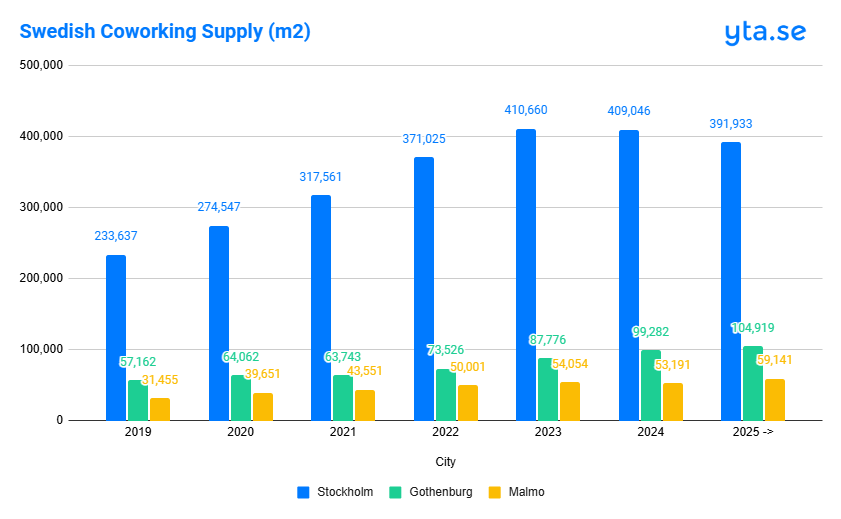

Over the past five years, the total amount of coworking space in Sweden has doubled. In Stockholm, coworking now constitutes 3.9% of the entire office stock, while Gothenburg is at 3.1% and Malmö at 2.7%. Within central districts, Stockholm’s ratio climbs to 7%, signaling an intensifying preference for flexible offices in prime areas.

Market share by revenue

Coworking makes up approximately 7% of Stockholm’s total office market revenue. Our projections at yta.se suggest this figure could double in the next five years, thanks to growing adoption of new, more flexible workspace models.

Size & Scope in Stockholm

With nearly 2.5 million people in its metropolitan area, Stockholm hosts more than 400,000 sqm of coworking space spread over 240 centers. Monthly private office rents average about 1,300 SEK per sqm, reflecting both high-quality environments and the premium services these spaces often include.

Local-Dominant Operators

Notably, Sweden’s largest coworking brands remain locally based. Beyond multinational names like IWG (Regus) and WeWork, few international operators have gained significant traction here.

At yta.se, we’ve closely tracked the Swedish coworking sector’s performance through 2023 and into 2024. Despite broader headwinds in the traditional office market, flexible spaces continue to gain momentum. Below, we present key findings from our latest research, offering a clear view of how coworking operators—large and small—are navigating a shifting landscape in Stockholm, Gothenburg, and Malmö.

Broader Market Challenges

Conventional office leasing in Sweden has slowed. Rising interest rates, economic uncertainty, and changing work habits have all prompted companies to reconsider long-term commitments. According to CityMark Analys, Stockholm City’s vacancy rate for traditional office space has jumped from 3% in 2019 to nearly 10% by 2024, reflecting a weaker overall office market.

This massive market shift undoubtedly puts pressure on the coworking market, but has also led to a stronger emphasis on flexibility, cost control, and the hybrid-work approach. As Sweden still employs a high degree of remote work compared to other nationalities, many companies feel the pain of large empty office spaces and have flexibility top of mind when evaluating new space.

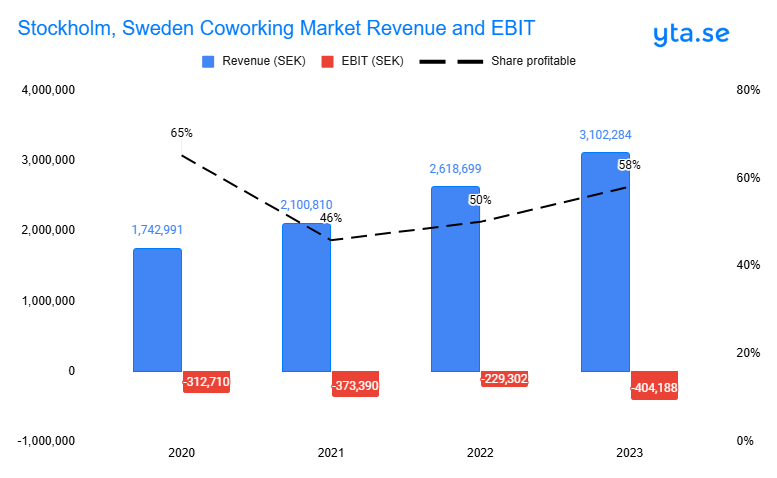

High Revenue Growth—But Profitability Remains Challenging

Within the coworking arena, top-line figures appear robust when comparing 2023 to 2022:

- Sector revenue in Stockholm grew from SEK 2.6 billion in 2022 to SEK 3.1 billion in 2023.

- Total losses, however, rose from SEK 200 million in 2022 to SEK 400 million in 2023.

While our analysis shows that more providers are turning a profit (up from 50% to 58%), operating costs—spanning from staffing and amenities to technology and marketing—continue to put pressure on margins. Compounding matters is the heightened competition among coworking brands and from traditional landlords experimenting with shorter leases and flexible features.

From Rapid Expansion to Strategic Realignment

Over the last few years, coworking saw explosive growth in Swedish cities. Yet in 2024, we’ve noted a distinct pivot:

Stockholm & Malmö

For the first time, both metros experienced a net decline in overall coworking supply, sparked by closures, mergers, and consolidations. Despite this shakeup, we see it as a necessary recalibration that could pave the way for a healthier, more sustainable sector moving forward.

Gothenburg

By contrast, Gothenburg added 12,000 sqm of coworking space—around a 13% boost. This heightened capacity has lowered occupancy rates somewhat, particularly for larger spaces, but underscores the city’s emerging reputation for innovative workplaces.

Evolving Tenant Demands

Our day-to-day work at yta.se has revealed how changing tenant expectations are shaping coworking in Sweden:

Hybrid Work

Employers increasingly divide employees’ schedules between home and the office. Short-term or month-to-month agreements have become hot commodities, offering businesses the freedom to scale up or down as needed.

Cost & Price Sensitivity

We’re seeing a trend toward transparent, “final” pricing. Operators competing for tenants now list prices that closely reflect the ultimate contract, appealing to organizations that conduct thorough price comparisons.

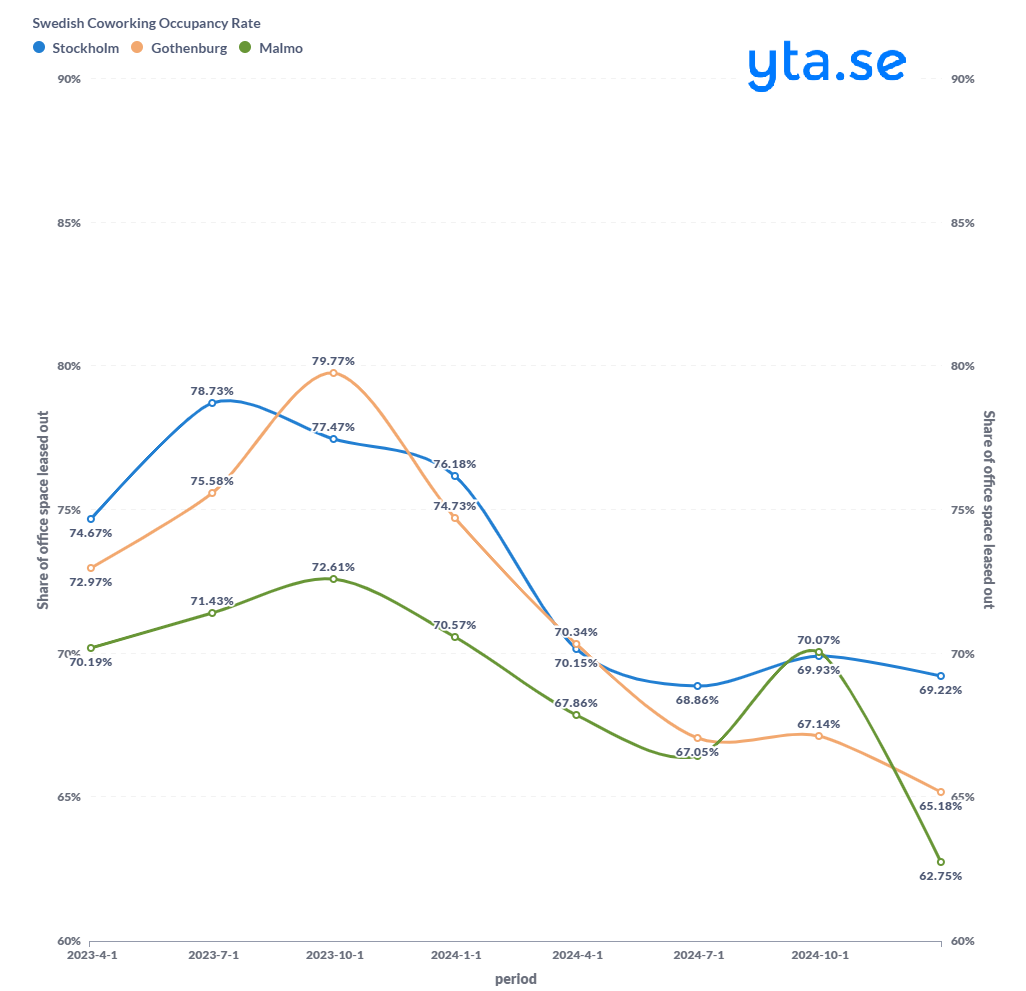

Occupancy Trends: Slowing but stabilizing

As new facilities still ramp up, occupancy rates in Sweden’s three main coworking hubs dipped across 2024:

- Stockholm: 69% (down from 76%)

- Gothenburg: 65% (down from 75%)

- Malmö: 63% (down from 71%)

We believe the combination of market uncertainty and a slew of recent openings explains most of this dip. However, as some locations close or consolidate, we anticipate a rebalance that may drive occupancy rates higher by 2025.

Pricing Trends: Competitive & Transparent

Based on the comprehensive data in our yta.se marketplace:

- Average monthly private-office rent in Stockholm is roughly 1,300 SEK per sqm, with Gothenburg and Malmö slightly lower.

- Premium Central Submarkets can surpass 2,000 SEK per sqm, driven by sought-after addresses and upscale amenities.

- Localized Variation remains prevalent, with building quality, location, and included services greatly influencing price points.

Coworking's Resilience Amid Tenant-Focused Landlords

Sweden’s office landlords typically cater closely to tenants:

- Short Conventional Leases (often three years) lessen the “flexibility gap” that coworking spaces have historically leveraged.

- Landlord-Funded Fit-Outs, folded into the rent, often come at a high standard.

- Close Tenant Relationships see landlords continuously updating space and services to retain clients.

- Flexible Initiatives from landlords—like shorter leases or in-house coworking concepts—confirm that demand for adaptability is now market-wide.

Despite these pressures, coworking operators maintain an edge by offering turnkey solutions, vibrant communities, and unparalleled agility. In our view, any landlord-led competition ultimately validates the flexible model’s long-term viability, encouraging further innovation.

Why the Swedish Example Matters

Sweden has a long track record of embracing forward-thinking workplace models. Our deep engagement with operators, landlords, and tenants shows that flexible, technology-driven workspaces can thrive even during challenging economic cycles. But the rising sector-wide losses also highlight the complexities of scaling profitability in an increasingly crowded arena.

Further Findings in yta.se's 2024 Market Report

For a deeper dive into district-level insights, pricing by room size, and projections for where Swedish coworking is headed, we invite you to access our full report. With data spanning real time vacancies over 10,500 offices, yta.se offers a uniquely detailed perspective on one of Europe’s most dynamic office markets.

Whether you’re a global property analyst, a coworking journalist, or a business leader exploring new workspace strategies, Sweden’s 2024 coworking landscape is a compelling case study—full of both opportunities and cautionary lessons.

Download the full report here (in Swedish):

*We at Yta.se are happy to share the insights from this report. You are welcome to use data and quotes as long as you cite 'Yta.se Coworking State of the Market Q4 2024' and Yta.se as the source and include a link to https://yta.se in any digital publication. Any distribution without proper attribution is not allowed. Feel free to reach out to our CMO daniel@yta.se if you have any questions or further inquires regarding the data or the Swedish coworking market.